Advance Auto Parts (AAP): Compelling Oligopolist Turnaround

AAP's new CEO and restructuring plan has yielded early results. Simply returning to historical margins can multiply the current stock price.

Disclaimer: This post reflects my personal opinions and is for informational purposes only. It is not investment advice. Readers should do their own research before making any investment decisions.

Introduction/Thesis

In Capital Returns, Marathon Asset Management writes that “the ideal capital cycle opportunity for us has often been one in which a small number of large players evolve from a situation of excess competition and exert what is euphemistically called ‘pricing discipline’”

The US aftermarket auto parts industry is the epitome of this description. In the early 2000s, the market was fragmented and regional. Since then, the industry has gone through an acquisition-driven consolidation around a few notable large players, who make up the majority of the US retail market. Let’s consider what this meant for the financial results of the top two players, AutoZone and O’Reilly. Not only have these two companies been profitable every year since going public in 1991 and 1993, respectively, they grew EBIT margins from about 10% in 2000 to around 20% today. Their pricing power has grown immensely. In fact, AutoZone’s EBIT margins increased every year through the 2007–2009 recession.

Behind the robust financial figures of these players are incredibly strong industry characteristics. Today, the industry has a unique barrier to entry given the large count of SKUs demanded by customers. O’Reilly itself supplies same-day or overnight access to an average of 153,000 SKUs according to their 2024 annual report. Advance Auto Parts and AutoZone supply almost a hundred thousand SKUs. One can imagine how difficult this would be to replicate for a smaller or new player. This is a key reason the industry participants have been able to maintain pricing power.

More recently, the industry has held strong, so far, despite auto tariffs. After all, when drivers can no longer afford to replace their old car, they have no choice but to invest in repairs in order to keep driving, even if repairs are more expensive than they were last year. In fact, during an earnings call, the CFO of AutoZone said, “To be clear, we intend to maintain our margin profile post tariffs, and we expect the entire industry will behave in a rational way as our historical experience has shown.” Both Advance Auto Parts and O’Reilly also reaffirmed pre-tariff guidance. Certainly, things can change and management predictions can go awry, but the industry has experience from Section 301 tariffs on Chinese auto parts in 2018. A 2019 Barron's article quoted Wells Fargo analyst Zachary Fadem in saying that as much as 45% of auto-parts products were directly sourced from China.

Advance Auto Parts (AAP) has been disappointing as the now fourth largest player. Despite employing the same acquisition-driven growth strategy as AutoZone and O’Reilly, their EBIT margins have historically hovered around 7%. When you look at how lazy their acquisition integration has been, it’s no surprise. A few years ago, the company had four different ERP systems, systems not supported by software, two separate supply chains, and high employee turnover. Whereas O’Reilly and AutoZone can offer same-day delivery, customers of Advance Auto Parts suffer from long waits and out-of-stock parts. Really, it is surprising they were able to even generate 7% margins. From another perspective, its track record of having operating profits (not net profit) since IPO is a testament to the power of its oligopolistic position.

However, AAP’s profitability record was recently broken. This follows former CEO Tom Greco’s multi-year plan to modernize systems and consolidate the supply chain. In hindsight, Greco’s plan was not executed properly and involved a two-tiered distribution model used by CPG companies instead of the auto parts industry standard, reflecting Greco’s background at PepsiCo and Procter&Gamble.

Following weak results, Greco was replaced by Shane O’Kelly, who has an extensive background as CEO of distribution companies and a military past. Over a year since his start, he has executed a strong plan that included the sale of a subsidiary for $1.5 billion, a reorganization of the team, and the start of a conversion of the supply chain to the industry-standard hub and spoke model. The company has already seen significant improvements in customer experience, including SKU availability and service time. If executed properly, his restructuring plan has the potential to finally position the company’s services competitively against competitors.

After a few quarters of silence on the turnaround timeline, O’Kelly has finally provided expectations for the next few years, guiding a return to 7% adjusted operating margins by fiscal 2027. Using expected fiscal 2025 revenues, this would represent around $595 million in “normalized” EBIT and about 5.4x EV/EBIT, compared to a 15-20x historical multiple. Past 2027, any incremental push to margins closer to those of competitors can further push the stock price up.

As of writing, the company trades at $3.09 billion in market cap and $3.21 billion in enterprise value.

History/Business Model

The current business model of Advance Auto Parts involves providing aftermarket auto parts to both professional repair shops and do-it-yourself customers through retail stores, online sales, and commercial delivery to professional installers. As of April 19th, the company owns 4,285 stores, 881 of which are franchised Carquest stores that historically cater to professional customers. The company claims that more than 75% of their store footprint will be in designated market areas with the number one or two positions based on store density. Their revenue mix is split around 50% professional and 50% DIY.

Since 2000, the company has made around six major acquisitions of retailers, a distributor, and a brand. Many of these acquisitions led to integration challenges. In particular, the acquisition of General Parts International, which closed in 2014, left AAP with two separate supply chains and incompatible systems. Under previous CEO Tom Greco, who joined in 2016, there were many signs of pressure from this operational mess. Having worked on updating systems “that were old to drink and vote in most states,” Greco announced and hosted a call for a “Strategic Update” in 2021. Greco planned changes that included consolidating the supply chain to a two-tiered distribution center model and aimed to reach 10-12.5% in operating margins by 2023. However, the company saw GAAP operating margins going down and adjusted operating margins staying flat in 2022. By the end of fiscal 2022, the company announced a succession plan for Tom Greco.

*Tom Greco’s envisioned supply chain conversion (similar models are used in CPG)

Current CEO Shane O’Kelly was put into position in September 2023 after several quarters of underperformance and a large dividend slash. O’Kelly was previously CEO of HD Supply, a distributor of maintenance, repair, and operations products owned by Home Depot. Before that, he was CEO of PetroChoice, the nation’s largest distributor of lubricants and lubrication solutions. In the past, he was also CEO of AH Harris, a specialty construction supply distributor. His background is picture-perfect given AAP’s supply chain issues.

Shortly after Shane O’Kelly’s start, he announced a five-step plan to restructure the company. This includes:

Sale of Subsidiaries: Worldpac and Canadian Businesses

Significant cost reductions: $200M of cost reduction by eliminating redundant roles and a reinvestment of $50M into employee retention in 2024

Organizational Changes

Closing Underperforming Stores

Consolidation of the Supply Chain

He quickly went to work, selling Worldpac to Carlyle for $1.5 billion at 15x EBITDA, executing the cost reduction program, and reinvesting into lower employee turnover. Worldpac was acquired through General Parts International and ran its own distinct systems, so it had been troublesome to integrate. The AAP team has also been revamped and includes a new CFO, Chief Accounting Officer, Chief Data Officer, and Chief Merchant. Antiquated systems like the POS and warehouse management systems have been or are in the process of being updated. Most importantly, he is driving the reorganization of the company’s distribution system into the hub-and-spoke model employed by AutoZone and O’Reilly.

Parts of the plan have been rapidly changing, but investors now have a clearer picture of what the company will look like after the restructuring. The decision to sell the Canadian businesses was canceled following O’Kelly’s visits. The company also closed over 500 underperforming Advance stores and 200 franchisees, which is expected to be the end to closures. Additionally, the supply chain structure appears to be finalized. Originally operating 38 distribution centers, the plan consolidates that figure to 12. Along with that, the supply chain will have 60 market hubs by mid-2027. This will mean more concentrated shipments to a smaller number of distribution centers and a large number of stores in the proximity of a market hub.

These changes have already led to significant improvements in customer experience. Time to serve has gone down 10 minutes to 40 minutes and AAP’s store availability KPI improved from low-90% to mid-90%.

Financially, management expects 2-3% adjusted operating margins after taking out restructuring costs in fiscal 2025. By fiscal 2027, the company hopes for adjusted operating margins of 7%.

Valuation

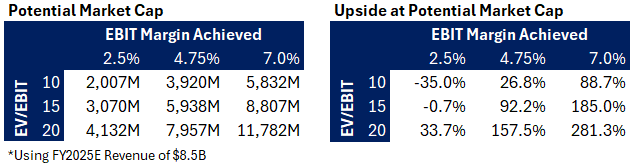

Based on AAP’s historical EV/EBIT of 15-20x and expected fiscal year 2025 revenue of $8.5 billion, below is a valuation matrix with different multiples and margins. I’ve also added upside calculations based on the current market cap of $3.09 billion. Keep in mind that management’s margin guidance is based on adjusted figures, so GAAP margins will be likely be lower. Also, management is aiming for $9 billion in revenue in fiscal 2027.

I would argue that Advance Auto Part’s multi-decade track record of profitability, strong market position, and the strong execution of Shane O’Kelly, so far, strongly supports the idea that the company can return to historical margins. From my perspective, the larger variable is when they achieve it.

If the company only manages to achieve 4.75% in EBIT margin by the end of 2027, at 15x EV/EBIT the stock is still about a double. If the company achieves a 7% margin and trades at a 15x EV/EBIT instead, the stock is about a triple.

Moreover, this does not consider the possibility of the company pushing past 7% margins in the future. O’Kelly has only alluded to the potential of this, but the expected operational improvements to the industry standard could push margins closer to the peer operating margins of 20%. Every incremental one percent increase could add around a billion to the market cap.

Risks

This thesis largely depends on Shane O’Kelly and his execution of the company’s restructuring. As previously mentioned, a plan to reorganize the supply chain was unsuccessfully conducted by prior CEO Tom Greco, which led to margins declining instead and the company’s current predicament. Though, Greco didn’t have O’Kelly’s strong distribution background and implemented, what I interpreted as, a flawed distribution system. O’Kelly’s decision to sell Worldpac, which was troublesome to integrate, and to convert the supply chain to the industry standard makes more sense intuitively. Along with O’Kelly’s other changes, management has seen initial success with weeks of sequential improvement to comps.

One clear downside to the thesis is the lack of tangible assets as a margin of safety. I believe that the low valuation and strong business position provides enough certainty of upside, but those who are comfortable may be interested in LEAPs instead. AAP’s January 2027 dated call options currently trade at a little over 50% implied volatility. This maturity date doesn’t provide exposure to the full length of the expected restructuring timeline, but could provide upside from fiscal 2026 results with a controlled downside in a worst-case scenario.

Conclusion

Advance Auto Parts is a company with a strong track record of profitability and an oligopolistic position with strong barriers to entry. Its current challenges are the result of, what I interpret as, an overly ambitious change to the business by the previous management team. New CEO Shane O’Kelly brings a great distribution background to the company and has been executing a much better restructuring plan, which has yielded early results. Simply meeting the expectation of return to historical margins will produce tremendous returns.